Breaking News

Finance

Bank of Japan Set for a Nine-Year Financial Marathon: Optimizing Economic Stability

Leo Gonzalez

March 5, 2024 - 21:18 pm

Monumental Challenge Ahead: Bank of Japan Faces a Nine-Year Normalization of Balance Sheet

In a landscape of financial uncertainty and unprecedented monetary policy, the Bank of Japan (BOJ) is standing at the threshold of a colossal task. After more than a decade of aggressive monetary easing, a former executive director at the bank has forecasted an arduous journey of at least nine years for the BOJ to normalize its balance sheet under the most optimistic scenario.

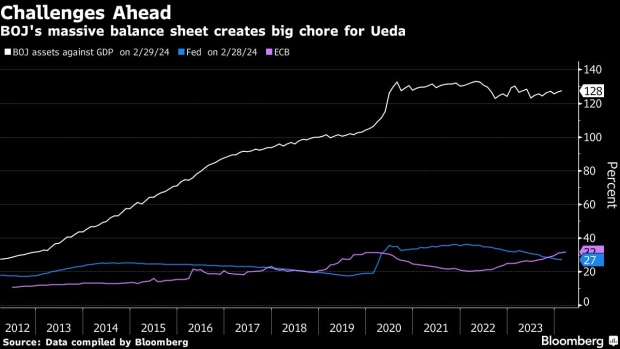

A Ballooning Balance Sheet

The daunting normalization process, as depicted by the former executive director Kenzo Yamamoto, is likened to traversing uncharted waters. In an interview, Yamamoto described the balance sheet's expansion as extraordinary, stressing that such a drastic change is an anomaly in the global banking landscape.

This financial institution, known for its conservative approach, anticipates initiating its normalization efforts by abandoning its negative interest rate policy as early as this month or in April. The impending shift, marking the BOJ's first rate hike since 2007, beckons critical questions from investors regarding the pace at which the bank intends to address its hefty balance sheet.

Yamamoto's perception of normalization paints a picture of reverting the balance sheet to a state slightly above the necessary reserves. This translates to an ambitious reduction of ¥440 trillion ($2.9 trillion) in bonds, necessitating an elaborate and cautiously plotted exit strategy from the current situation.

The Exposure to Market Uncertainty

He warns of the term "normalization" becoming the epicenter of discussions and emphasizes the necessity for structured guidance on the process. Without clear direction, the stakes are high for market yields to face periods of extreme volatility, exacerbated by speculative trading activities.

An analysis of the BOJ's portfolio maturity reveals that only a fraction – less than a quarter – of the bank's assets are set to mature within a 12-month timespan based on a snapshot from November. This is in stark contrast to the bank's previous quantitative easing cycle that ended in March 2006, during which two-thirds of the assets were maturing in a year, enabling the bank to downsize its balance sheet within a mere six months.

"The vision of a nine-year normalization process may seem unrealistic, akin to chasing a mirage," Yamamoto mentioned, putting forward an estimate rooted in a basic computation of assets and their respective maturities without considering further bond purchases or reinvestments. However, a complete halt in operations is not on the horizon, as BOJ aims to maintain market equilibrium.

Strategic Approach to Reduction

For more insights, you may visit BOJ Signals Rate Hike Is Getting Closer, Sparking Yen Rally.

Drawing from wisdom shared among central banks, Yamamoto suggests that the best practice for BOJ would be to halt additional asset acquisitions before progressively downsizing the balance sheet. This approach, he says, must be prefaced with a well-communicated plan that would allow market participants to factor in expectations adroitly.

A Comparative Lens: The Federal Reserve's Experience

The Federal Reserve serves as a comparative benchmark, having initiated the contraction of its asset holdings, which predominantly comprise Treasuries and mortgage bonds backed by government agencies, in June 2022. A cap facilitates the maturation of $60 billion in Treasuries and $35 billion in mortgage-backed securities each month without redeployment.

Since scaling back its balance sheet by over $1 trillion from its pinnacle, the Federal Reserve's strategy has sparked debates over the extent to which it can feasibly downsize its holdings without triggering disturbances, particularly in markets such as the repo agreements.

For an extended breakdown, refer to Envisioning the End of Fed’s Quantitative Tightening: QuickTake.

BOJ's Second-in-Command Shinichi Uchida brought to light last month that the bank's balance sheet blueprint has yet to be solidified, stating that had there been a concrete plan, it would have been included in his address.

The Fiscal Conundrum

Japan's attitudes towards fiscal discipline have loosened, forecasted to pose a formidable hurdle in BOJ's transition. The government has enjoyed the luxury of raising debt at negligible costs, thanks to an enduring era of low interest rates. Despite Prime Minister Fumio Kishida's commitments to escalate expenditures on childcare and defense, the quest for a funding source remains unresolved.

Nevertheless, the BOJ remains steadfast in its claim that its bond purchases are driven by the imperative to meet the price target, not to underwrite government expenditures. Validating this claim indispensably involves terminating bond acquisitions and reducing the balance sheet once the objective is accomplished.

To withstand economic downturns without succumbing to pressures for bond procurement – pressures compounded by extensive buying during the era of massive monetary easing – is the tightrope the BOJ must walk. "The BOJ must clearly delineate its boundaries," states Yamamoto, underscoring the criticality of establishing clear limits.

The ETF Conundrum

Yamamoto predicts that the path to liquidating the BOJ's exchange traded funds (ETFs) holdings would be more prolonged than the overall balance sheet normalization. The intricacy of this task is amplified by the bank's growing reliance on ETF-held revenues.

"The most feasible option lies in selling these assets at a snail's pace," he insists, suggesting that the endeavor could stretch over several decades.

Navigating the Road to Normalization

As the BOJ prepares to charter this formidable course, its navigation will have profound implications not only for its own financial health but also for the stability and confidence of global markets. While the timeline posited by Yamamoto extends deep into the future, his advice on a clearly communicated, phased approach reflects a foundational principle for central banks around the world.

In pursuing this path of steady unwinding and balance sheet reduction, the Bank of Japan undertakes a journey that is both a testament to its unprecedented measures in the face of economic adversity and a signal of cautious optimism for the future of its monetary policy.

Conclusion

The Bank of Japan, adorned with a rich history and influential role in the global economy, stands before a decisive moment that calls for strategic sagacity and steadfast resolve. As it embarks on its quest for normalization, the landscape ahead promises to be both complex and compelling, demanding meticulous planning and unwavering commitment to achieve a financial equilibrium that has eluded the institution for years.

The lessons drawn from this experience will not only chart the future course for the BOJ but will also serve as valuable reference points for central banks worldwide. It is a pivotal chapter in the narrative of monetary policy, marked by thoughtful deliberation and an unyielding pursuit of economic stability.

As we monitor the BOJ's progress, the eyes of the world remain fixed on how its strategies will unfold, influencing economies and shaping the contours of international monetary discourse. Indeed, the journey to normalization is not merely a fiscal maneuver but an endeavor steeped in global significance and profound ramifications for future generations.

This news article is based on information provided by Bloomberg L.P. and has been thoughtfully crafted to deliver comprehensive insights into the Bank of Japan's monumental task ahead. For further information on this topic, please access Bloomberg's comprehensive articles through the following links: BOJ Signals Rate Hike Is Getting Closer, Sparking Yen Rally and Envisioning the End of Fed’s Quantitative Tightening: QuickTake.

©2024 Bloomberg L.P.

broker updates© 2024 All Rights Reserved